When trading is close to perfect

Fintokei just hit a major milestone - $7,600,425 in payouts! Our traders are on fire, pulling off incredible moves like never before. Take Andrea and Kamila for example. Their performance is unlike anything we’ve seen. Dive into the article and see for yourself!

When someone tells you that trading in the summer is pointless, don’t believe them. At Fintokei, we’ve seen a record-breaking number of payouts this summer, totaling over $7,600,425! The average payout for ProTrader clients? An impressive $4,364.

And when our clients achieve something exceptional, it’s worth celebrating. For this article, we sifted through a wealth of payout data to find the standout traders—Andrea and Kamila. In an industry often dominated by men, they’re a refreshing change.But we didn’t spotlight Andrea and Kamila just because they’re women. Not at all. They’ve pulled off something no one has done before. Curious? Keep reading to find out what sets them apart.

And if you’re ready to test your own trading skills, now might be the perfect time. Before you dive in, explore which Fintokei challenge should you choose. Each program has its own unique features, and choosing wisely is just as important as making smart trades.

Top trades of September

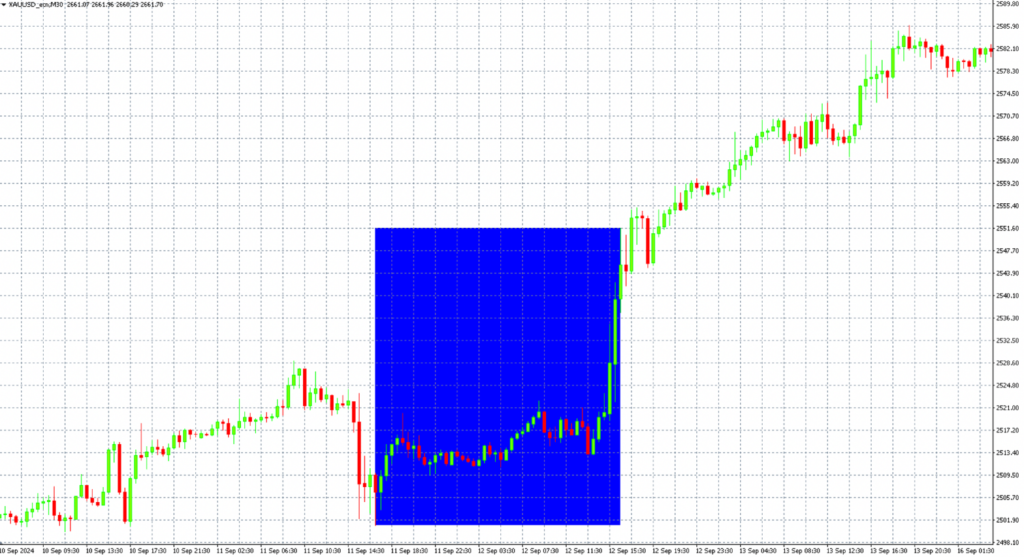

Cold-blooded precision on gold

Instrument traded: XAUUSD

Trading Style: Swing + Intraday

Total profit: $3,121

You might be thinking, “$3,121 isn’t the biggest profit we’ve highlighted.” And you’re right—but that’s not the whole story. For Andrea, it wasn’t just about the goal; it was about the journey. There’s a lot here that traders, especially beginners, can learn from.

Andrea jumped into the ProTrader 1,000,000 CZK program (equivalent of ProTrader $ 50,000 program) at the end of August and got straight to work. She passed the first phase, then the second, reached her 50k account, and traded on it for 14 days. Less than three weeks after starting, she was cashing out $3,121. Out of 14 trades, only 3 were losses—a remarkable achievement that we don’t see every day.

Andrea made a smart choice by focusing exclusively on gold—an instrument known for its readability and often recommended to beginner traders. Her trading style stood out for its patience in waiting for ideal entry points, and she avoided holding positions too long. She knew exactly when to exit.

One of her most impressive trades brought in nearly $2,167. She positioned herself between two key US inflation reports, demonstrating her deep understanding of how interest rates and the dollar impact gold’s price. Her timing was impeccable; she opened a trade around the release of US inflation data, with the market anticipating a drop to 2.5%—the lowest since 2021. Speculation also swirled about whether the Federal Reserve would cut rates.

With inflation lower, the possibility of a rate cut would typically weaken the dollar, which could boost gold. Andrea clearly understands what instrument to watch when trading gold. And the inverse correlation between gold and the dollar. When the dollar falls, gold tends to rise. And while the inflation data did meet expectations, the market reacted unpredictably—reminding us all of the importance of adaptability in trading.

Gold initially dropped from $2,520 to $2,500, a significant psychological level with strong resistance. When it didn’t break through, Andrea sensed her trade was taking an interesting turn. All she needed now was a clear signal to give gold the push it needed.

That signal came in the form of another inflation indicator: producer prices, which came in better than expected. Gold then surged to $2,550, and Andrea exited her position, locking in a profit of approximately $2,200 USD. It was a well-timed move that exemplified her skill in seizing opportunities at the perfect moment.

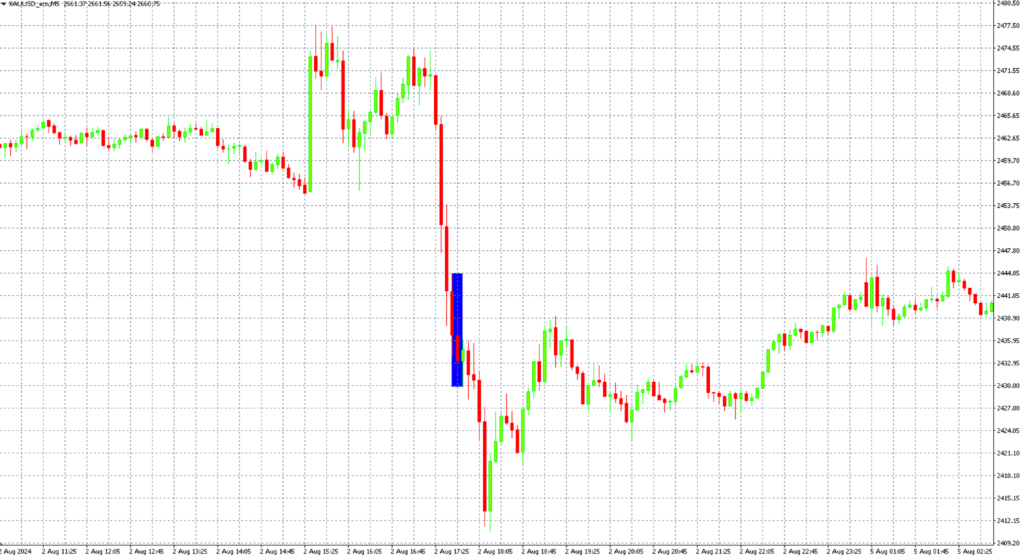

A month of trading without a single losing trade? It’s possible.

Instrument traded: XAUUSD

Trading Style: Intraday/Scalping

Total profit: $6,718

Kamila, another standout trader, also favored gold, but her stats are even more impressive—she hasn’t had a single losing trade in a month. All of her trades were scalps, with each position open for mere minutes.

Over the course of the month, Kamila executed 11 trades, choosing her setups carefully and avoiding unnecessary risks. Her success rate is extraordinary, with one of her best scalping trades on gold bringing in over $570 USD in just 8 minutes.

This standout short trade on August 2 was fueled by multiple factors that heightened market volatility. First, the Bank of Japan announced further rate hikes, effectively dismantling popular carry trades on the USD/JPY pair and prompting many traders to close positions. Adding to this, the U.S. released labor market data that same afternoon, which hinted at a potential recession.

The data release at 14:30 revealed significant labor market weakening and fulfilled the Sahm rule—an indicator that a recession could be on the horizon. According to this rule, if the average unemployment rate over the last three months is 0.5% higher than the lowest rate of the last year, it can signal the start of a recession.

As panic spread through the markets, even gold—often seen as a safe haven—wasn’t immune. You might wonder why, but when true market turmoil hits, cash becomes king. Just like in the 2008 recession, gold took a hit.

The real crash in gold unfolded after 5 pm, with prices plunging $60 down to $2,410 within 40 minutes. On the 5-minute chart, there was a steady downtrend with only brief pauses, ideal for entering positions with a controlled stop loss. Kamila seized this opportunity, entering a short position at 17:42 and securing over $570 USD in just 8 minutes.