Chart Patterns and How to Trade Them

Every pro started with these, and many still swear by them today. Chart patterns are the foundation of technical analysis, and this article will guide you through them.

What Are Chart Patterns?

Chart patterns (or trading chart patterns) are unique groupings of candlesticks on a technical analysis chart. Unlike simple candlestick patterns, they span more candles and take longer to form.

Why care about them? Because chart patterns trading helps predict where the price is heading. Whether you’re trading stocks, commodities, or forex, identifying chart patterns gives you insight into whether the market is about to reverse or continue its trend.

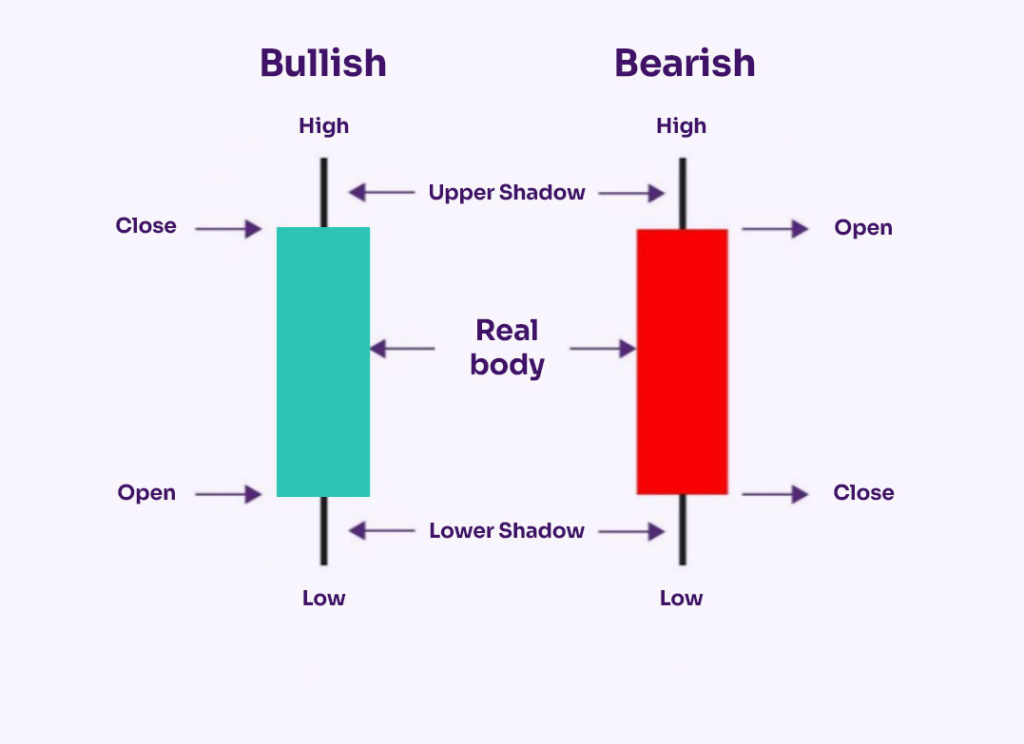

Before diving into these patterns, ensure you know the basics of candlestick trading. Each candle tells a story about price movement, from the opening to the closing price, and even the market’s highs and lows.

Why Use Chart Patterns?

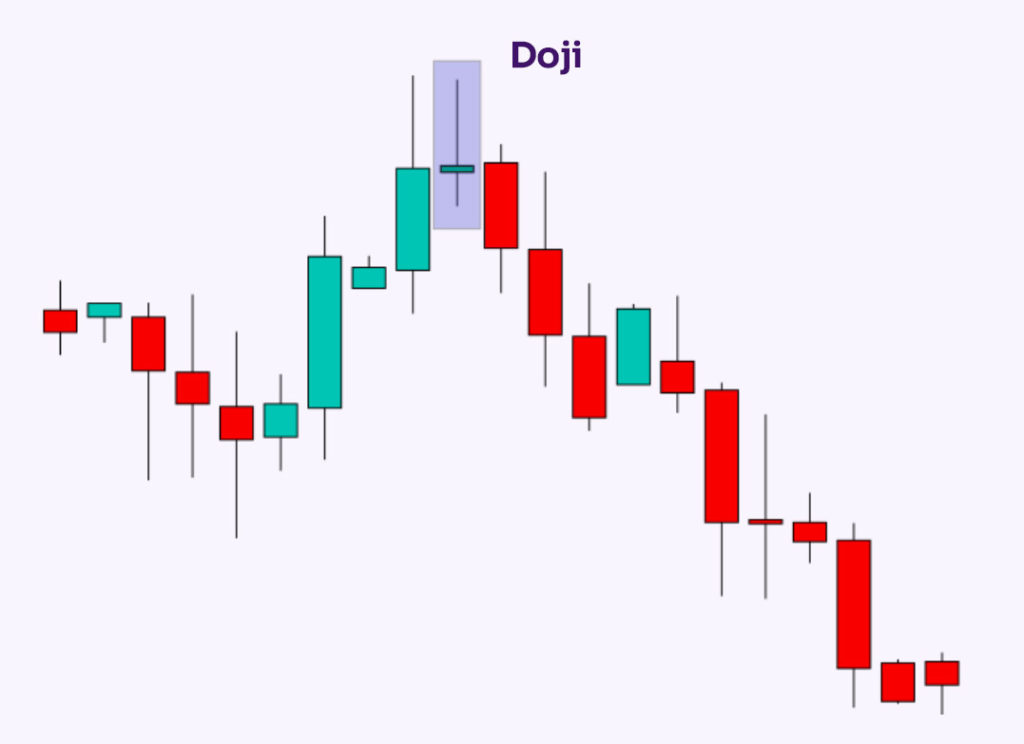

Trading chart patterns is not just about finding random shapes on the chart. Each pattern gives you insight into the current market sentiment. Some patterns indicate indecision, others confirm price direction or signal a reversal. You’ll often use trend lines to identify chart formations. We’ve also covered how to correctly identify a market trend on our blog.

For example, chart patterns that last for a longer period of time (perhaps even dozens of candles) are much more reliable than those that occur over a short period. That’s why it’s a good idea to use them as part of a comprehensive trading chart analysis.

Market Psychology in Chart Patterns

Think of a chart as a battlefield between buyers and sellers. Rising prices? Buyers dominate. Falling prices? Sellers have the upper hand. This battle is reflected in each candle.

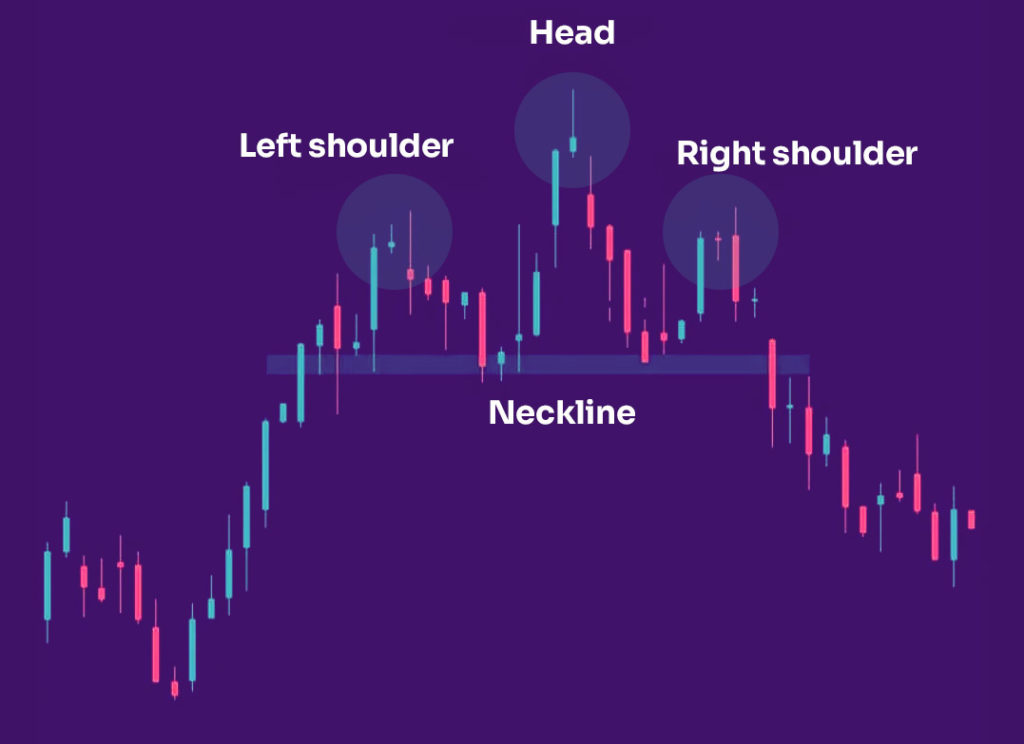

For instance, a “Doji” candle (shaped like a plus sign) signals indecision—traders are waiting for the market to pick a direction. Larger patterns, like “Head and Shoulders” or “Double Bottom,” narrate the bigger picture of trend evolution.

Types of Chart Patterns

Reversal Chart Patterns:

These show that the current trend is likely to change direction. Examples:

- Double Top: Signals the price may drop after reaching a peak twice.

- Head and Shoulders: Suggests a market trend is about to reverse.

Continuation Chart Patterns:

These confirm that the current trend will keep going. Examples:

- Flags and Pennants: Compact patterns that suggest the trend will resume after a brief pause.

- Triangles: Often used in chart patterns forex trading to indicate consolidation before a breakout.

Trading Chart Patterns Like a Pro

To trade these patterns:

- Spot the pattern early.

- Plan entry, exit, and stop-loss levels.

- Combine patterns with other tools like technical indicators for better accuracy.

Remember, no pattern is 100% reliable. Always use them alongside other analyses to improve success rates.

Start spotting chart patterns on your trading chart today! With consistent practice, you’ll learn to identify profitable opportunities and enhance your trading skills.