Martingale and how it can get you into trouble

What is the prohibited Martingale technique, and why can it lead to an account breach? Join us as we explore a real-life case and provide a calculator to help you avoid using Martingale.

We recently published an article on trading practices that won’t get you far at Fintokei. We were responding to the increasing number of individuals attempting to meet trading challenges or reach payouts dishonestly, which strains our infrastructure and limits opportunities for honest traders. Martingale and aggressive averaging are just two of these problematic techniques.

Today, we will describe the Martingale technique using a real-life example. Not long ago, we had to close a client’s account due to their persistent use of Martingale, despite repeated e-mail notifications and efforts to find a mutually acceptable solution.

What is Martingale (Aggressive Averaging)?

Martingale is a high-risk trading strategy where you aggressively increase your position sizes after a loss, aiming to gradually offset losses and eventually turn a profit. This approach might seem like a quick way to recover and win big, but it dangerously overlooks the potential for significant losses. The core issue with Martingale is that it treats trading like gambling. The trader believes that after a series of losses, the market is bound to turn in their favor. When it does, they plan to recover all previous losses by exponentially increasing their positions.

Martingale Calculator

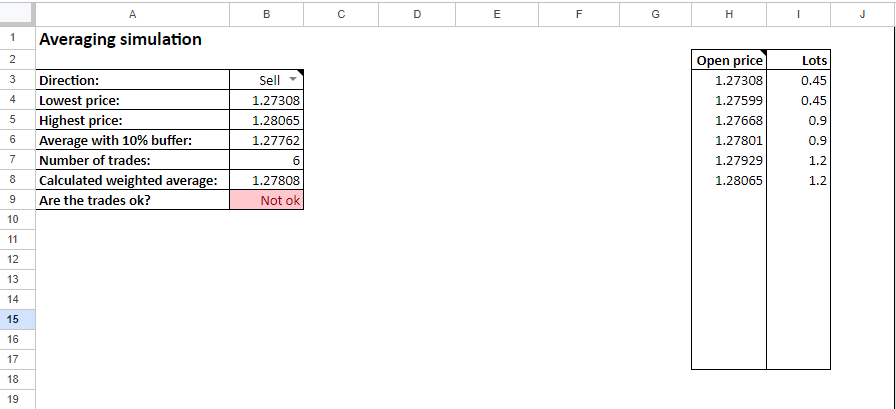

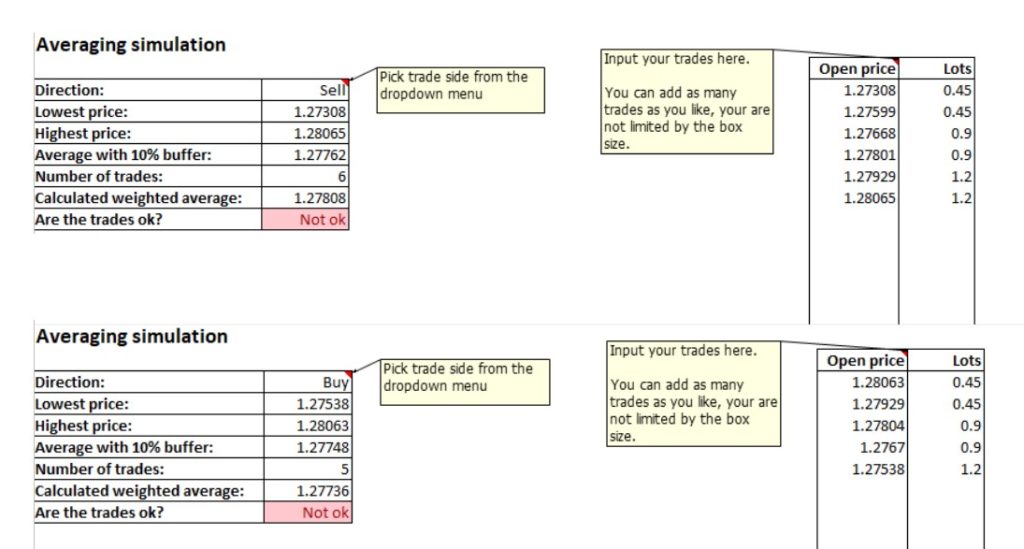

For traders who are not sure if their trading is too close to be classified as Martingale, we have created a simple excel calculator. Using the calculator is really simple:

- When you open the Excel file, you will only need to enter two pieces of information – the opening price of the trade and the trade size.

- The trades must be on the same symbol, traded in the same direction (long/short).

- In addition, the trades must belong to the same trade group (we will explain what a trade group is below).

How Do We Define a Trade Group?

A trade group consists of multiple trades opened in the same direction on the same symbol, with the first trade in a drawdown. For these trade groups, the closing time is crucial. If you close more than two of these trades simultaneously, you should input them into our calculator. This tool will help determine if Martingale was involved by checking the line labeled “Are the trades OK?”.

Martingale Example from Practice

The image above features our Martingale calculator, illed with real trades (group n. 1) from one of our clients. In just one day, he executed 14 positions, and we identified 11 of them as Martingale trades.

These were 2 groups of trades:

Group 1

Direction: Short

Number of trades: 6

Closing time: 12:06 server time

Group 2

Direction: Long

Number of trades: 5

Closing time: 16:51 server time

At Fintokei, we closely monitor accounts to ensure that Martingale trades do not exceed 10% of the total daily trading volume. If they do, we send a warning email, giving the trader a chance to stop aggressive averaging. However, if a client’s Martingale trades make up more than 50% of the total volume right from the start, we immediately breach his/her account.

In the case above, we classified over 50% of the client’s trades as Martingale. These trades were executed after we sent a warning email. Despite the warning, the client continued to aggressively average, prioritizing this risky strategy over maintaining his account. As a result, we had to cancel his account, making him an exemplary case for this article.

Fintokei and Martingale – how do we proceed?

- We will only start assessing your account after you have opened more than 5 trades in your account.

- If we classify more than 10% of your total cumulative trading volume (in lots) as overly aggressive averaging, we will send you an initial warning.

- If you exceed this threshold the next day despite the warning, we will have to close your account.

- If at any time we determine that more than 50% of your trades are part of overly aggressive averaging, we will terminate the account without warning.

We still assess every case individually

We are not and never will be fans of blanket restrictions and instant bans. We also know that it doesn’t always have to be intentional on the part of the errant trader. That’s why we handle all cases individually and always give our clients room for explanation and dialogue.