How to trade on a mobile phone?

Want to trade on your mobile phone? Be sure to read this article for basic tips and a strategy specifically suited for mobile trading.

The warm summer months and beautiful weather make outdoor activities and traveling more appealing. Whether you go on a holiday abroad or just grab a drink with friends, having a smartphone in your pocket means you don’t have to miss out on trading opportunities and potential profits.

First, you need to know the basic rules, tips and tricks for trading on mobile platforms. The small screen of a mobile phone can be quite limiting compared to a computer monitor. So, to get the most out of trading on your mobile phone, you’ll need to adapt to its conditions. In this article, we’ll show you how.

At the end, you’ll also find a basic trading strategy suitable for mobile phones.

Tips for trading on mobile phone

Tip 1: A Good Signal is Essential

The speed at which your order reaches the market is crucial in online trading. This applies to prop trading as well, where you trade with virtual capital in a simulation of the real market. The faster your order appears on the market, the more likely it will execute at your desired price. So, if you want to trade on mobile, always make sure you have the strongest signal possible.

Tip 2: Unlimited Data Plan

Imagine you’re out cycling with friends, and you stop at a pub for a break. Suddenly, you get a beeping alert about an interesting trading opportunity. You pick up your mobile phone, open the trading platform, and just as you’re about to enter the deal, you get a text from your operator: “You have used up your current data allowance and are now without internet.”

Asking for the Wi-Fi password from a busy bartender in a remote pub probably won’t get much further, so you miss out on the trade and potential profit. The solution is simple – if you want to trade on your smartphone, get an unlimited data plan.

Tip 3: Set Up Notifications

The “beep” alert mentioned earlier is a key aspect of mobile phone trading. The idea of trading on a mobile phone is to be able to do other activities without missing a trading opportunity. That’s where setting up alerts can help.

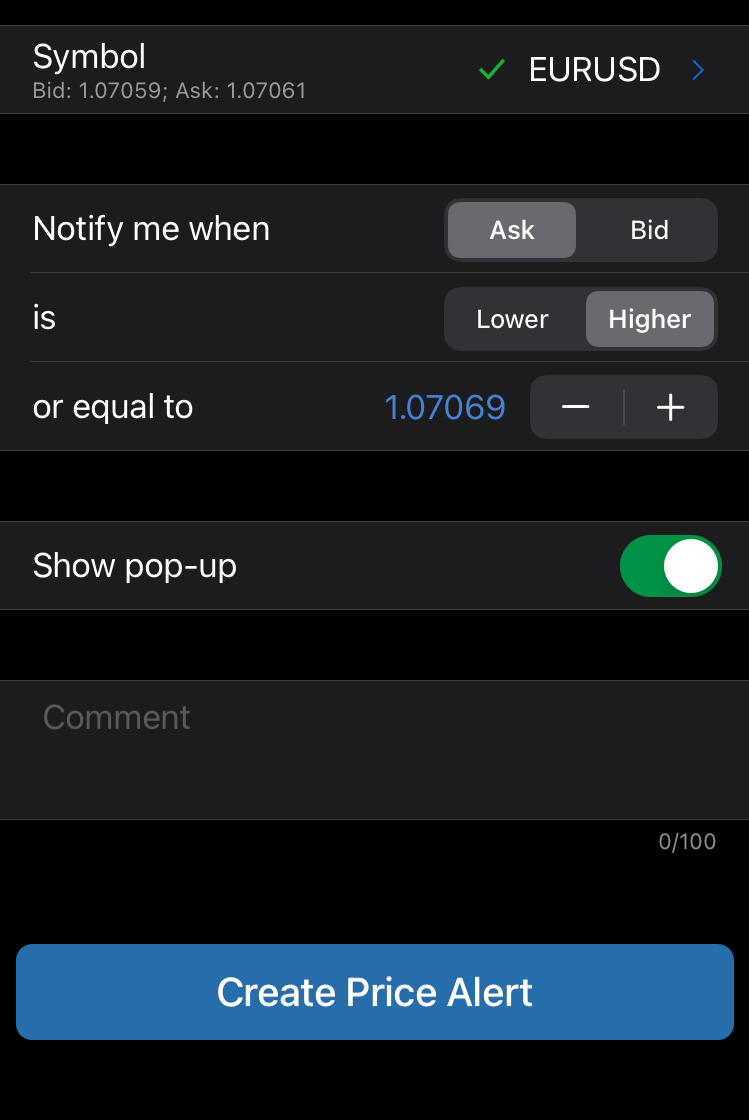

Alerts are also very useful if you’re trading correlations. Since a mobile phone screen doesn’t allow you to view multiple charts at once, tracking correlations can be tricky. Alerts can help you with this. For example, if you’re trading gold (see what instruments and indices to watch when trading gold), you can set up alerts for the dollar and silver. When the prices of these reach the levels you specify, an alert will beep, letting you know.

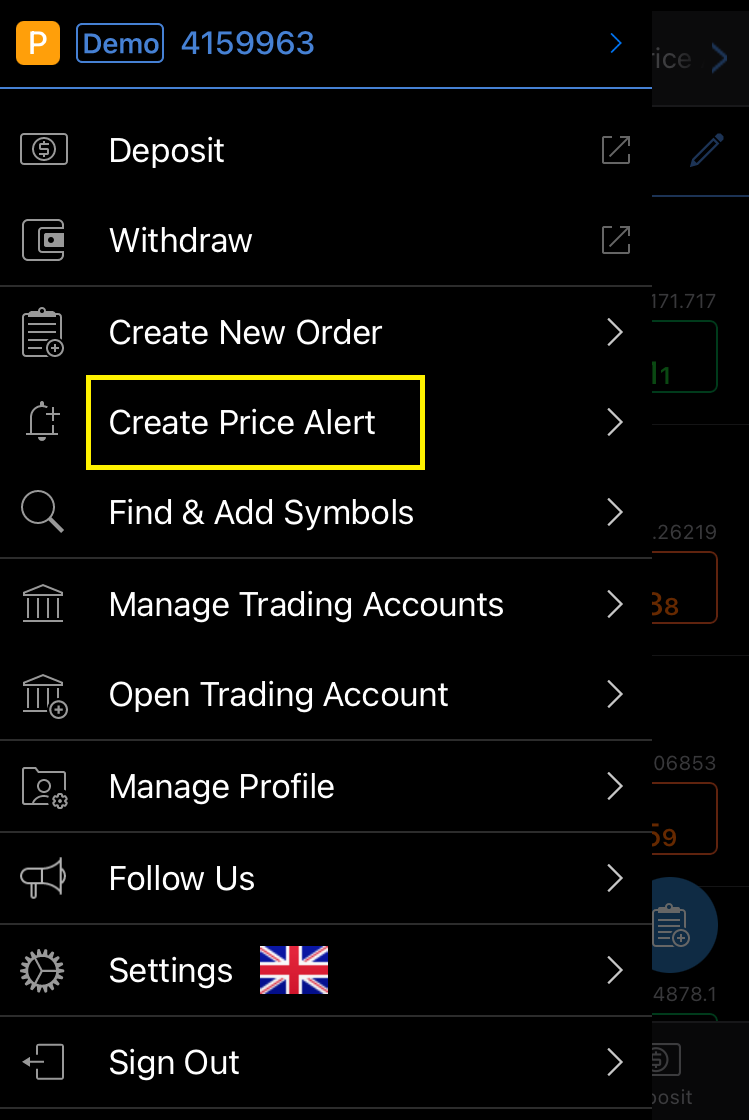

You can set up price alerts directly from the main menu of the cTrader mobile app

Tip 4: Use Stop Loss and Take Profit Levels

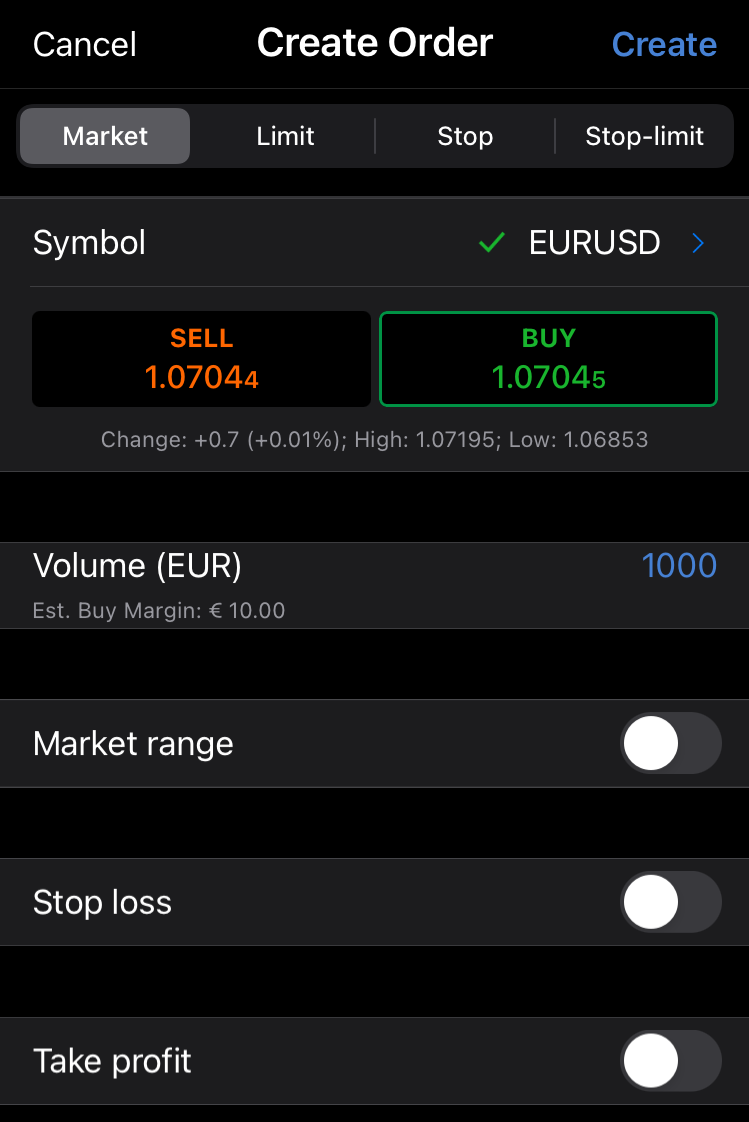

This tip applies to all trading, not just on mobile phones. At Fintokei, we seek consistent traders, not gamblers. To succeed, using stop loss (SL) and take profit (TP) levels is essential for effective risk management.

For mobile trading, these features are even more crucial. For example, if you enter a trade on your mobile and lose mobile signal (see Tip #1!), having SL and TP levels set means your trade is somewhat protected. However, if you don’t have these levels set, you may get a very unpleasant surprise when the signal kicks your platform back to life.

Likewise, setting SL and TP levels may allow you to put your phone away and let the trade sort itself out without your supervision. But we all know that only the most stoic can handle this scenario, and a normal mortal is usually unable to not glance at a trade at least once in a while.

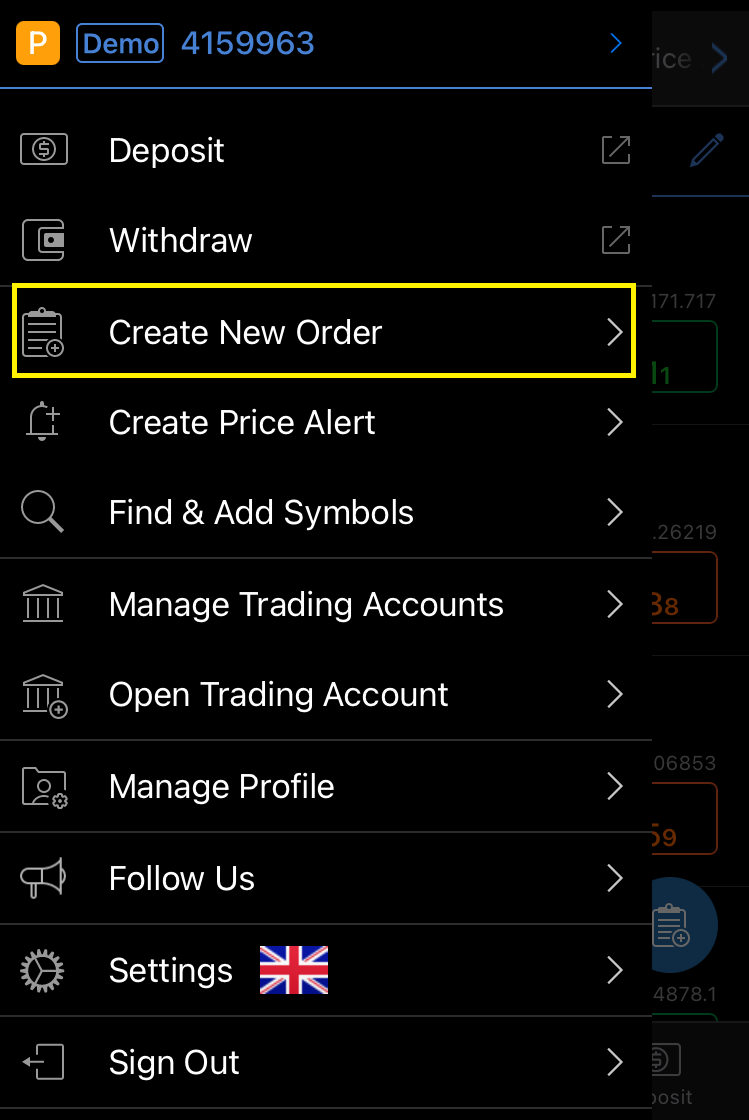

Stop loss and take profit levels are set in the cTrader mobile platform when you place a new order

Tip 5: Avoid Low Time Frames

The lower the time frame, the higher the need for precise positioning and the less room for error. No matter how advanced your mobile phone is, a touch screen simply can’t compare to a large monitor with a mouse and keyboard. Plus, on a computer, you can use various automated trading systems (EA) to help with position entry. While we allow these at Fintokei, there are some EAs and trading practices that won’t get you far at Fintokei.

This doesn’t mean mobile phones aren’t suitable for trading! You just need to approach it the right way. We recommend trading on mobile phones using time frames of 15 minutes or higher. This gives you time to think things through and enter as accurately as possible without risking uncorrectable mistakes.

Tip 6: A Mobile Trading Platform Should Not Be Your Primary Tool

While trading on a mobile phone is very convenient, it should be a secondary trading method. We recommend making your most important trades on a computer, where you have a clear monitor, multiple tools, and the ability to view multiple charts side by side for a better market overview.

However, if you want to enjoy the flexibility and freedom of trading on a mobile platform without being limited by a small screen, consider trading on a tablet. The cTrader mobile platform works on tablets and offers much more convenient controls. For example, you can enter stop loss and take profit levels directly on the chart.

Basic Forex Trading Strategy for Mobile Trading

Now that you know what to look out for in mobile trading, it’s time to introduce a basic trading strategy. While this strategy can certainly be used on a computer, it is perfect for mobile apps due to its simplicity.

Crossing of Moving Averages

This very popular and simple trading strategy uses the crossing of short-term and long-term moving averages. Many traders use it in combination with other indicators to confirm trade entries, and we recommend doing the same. It works well when combined with correlations or candlestick formations.

- Suitable trading instrument: Highly liquid, ideal EUR/USD

- Recommended risk management: No position should risk more than 1-2% of the total account volume

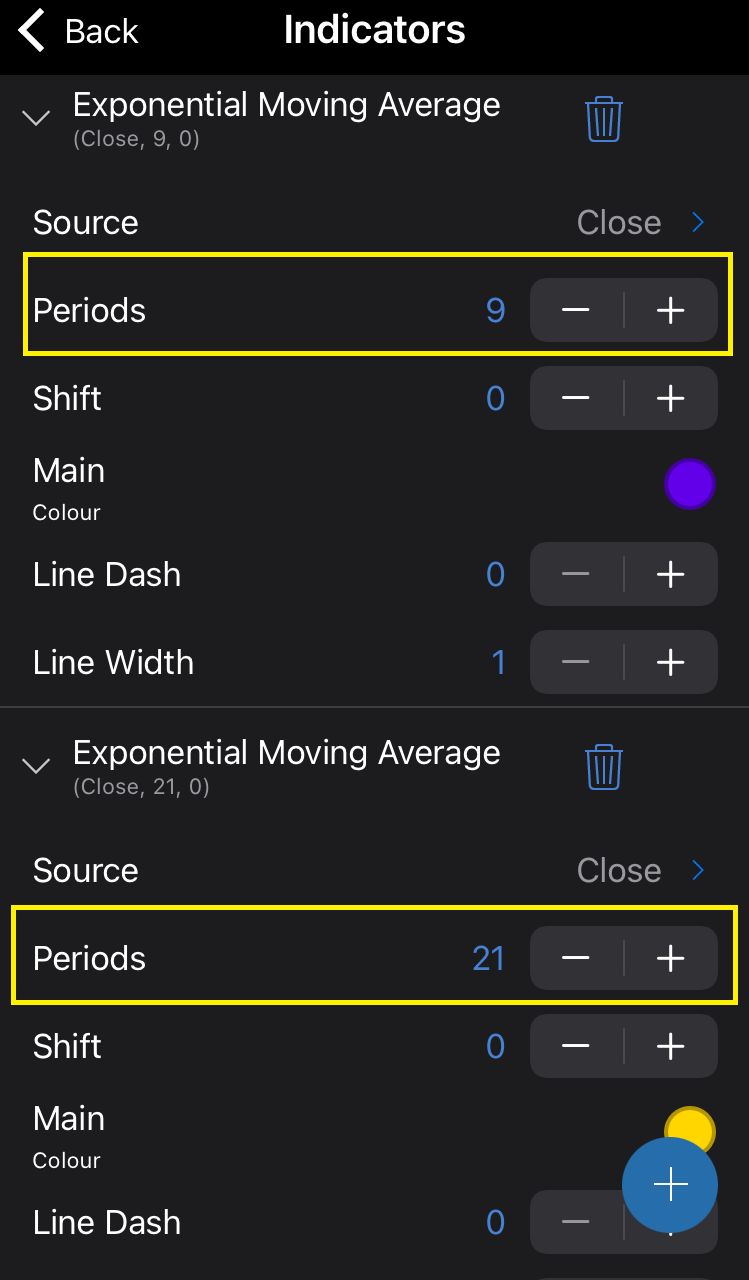

Step 1: Set up the moving average display

- Short-term moving average (for example, 9-day EMA)

- Long-term moving average (for example, 21-day EMA)

First, make sure that the symbol you want to trade is on full-screen mode. To do that, just tap the yellow highlighted button.

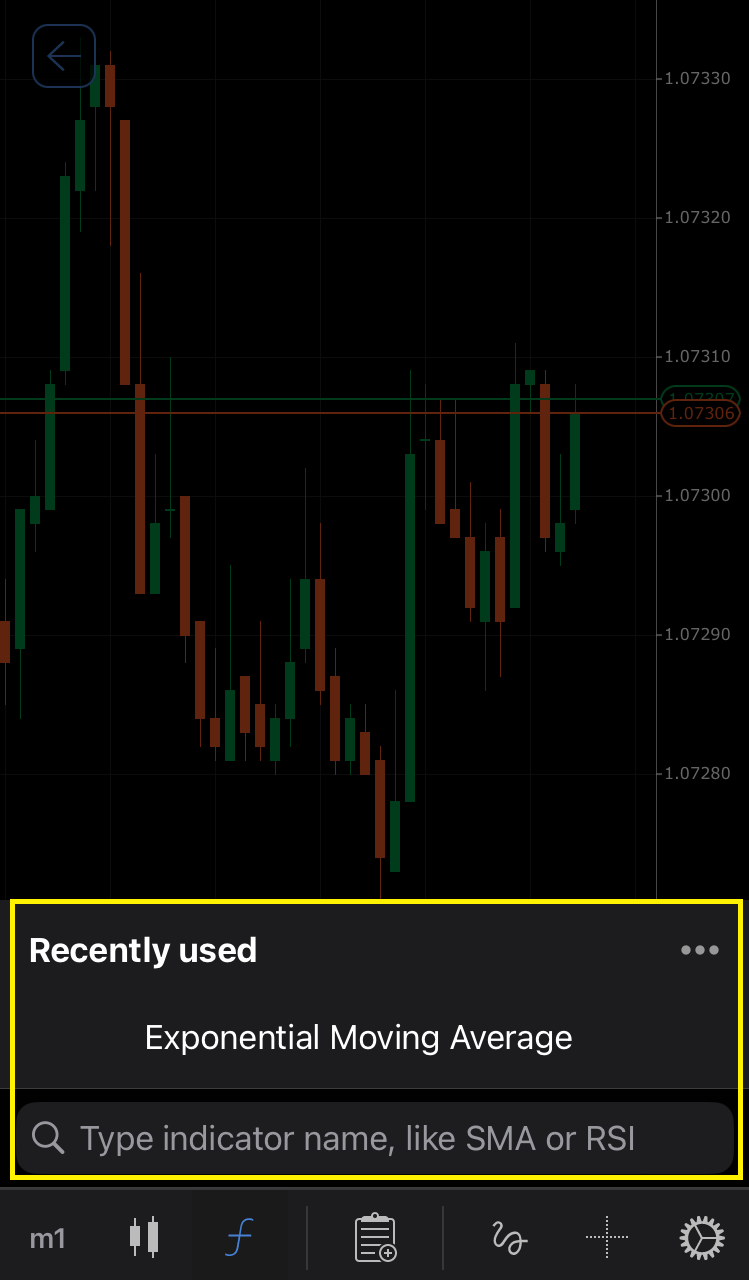

You can insert moving averages into the chart of a traded symbol by tapping the f symbol and then typing their name in the search line.

For our strategy, we want 2 moving averages. One with a period of 9 days and the other with a period of 21 days (see yellow box).

Step 2: Wait to enter the market:

In the long direction

- If the 9-day EMA crosses the 21-day EMA from above, this is a bullish signal that may be a harbinger for a possible uptrend.

- At this point, we recommend looking for further confirmation of an uptrend in the market, for example in the form of candle formations (e.g. bullish harami, etc.).

In the short direction

- If the 9-day EMA crosses the 21-day EMA from below, this is a bearish signal that may be a harbinger for a possible downtrend.

- At this point we recommend looking for further confirmation of a downtrend in the market, again candle formations (e.g. bearish harami etc.) may help.

Fintokei Tip

Signál pro vstup ve směru short (překřížení 9denní EMA zespodu 21denní EMA) může být zároveň signálem pro výstup v případě, že máš otevřenou obchodní pozici ve směru long a naopak

Step 3: Set stop loss and take profit levels

- To set the stop loss, switch to the 1H timeframe and look for the low of the previous day, place the SL nearby (in case of trading in the long direction)

- Place the take profit at a maximum of twice the distance of your stop loss (e.g. if SL is 50 pips away, set TP at a maximum of 100 pips) – again, for trading in the long direction.

- In the case of trading in the short direction, you derive the SL from the previous day’s high, again on a 1H frame.

Step 4: “Live life”

That’s it, the trading position is in the market, SL and TP levels are set, now you can put your mobile phone away and get on with other activities. That’s why you trade on your mobile phone, right?

This trading strategy is a fundamental one, but it can also be used effectively on mobile screens. However, we recommend learning other basics of technical analysis, such as candlestick formations. These can provide additional insights into the market and increase your chances of making a profit.