Drawdown and High-water mark – the only two parameters you MUST watch when trading with Fintokei

Want to complete the Fintokei challenge and receive regular payouts? Then you need to know how a drawdown works or what a high-water mark is.

Want to complete the Fintokei challenge and receive regular payouts? Then you need to know how a drawdown works or what a high-water mark is.

Whether you decide to tackle the markets with ProTrader, or bypass the challenge and directly manage our virtual capital on SwiftTrader, keeping an eye on your losses is crucial. At Fintokei, we focus on drawdown as the primary metric for monitoring traders. Exceeding this limit is considered a hard breach of our rules and leads to failure of the trading challenge or termination of your trading account.

Each of our programs has its own method for calculating the acceptable level of loss, or drawdown, on your account. Let’s dive deeper into how these calculations vary depending on the program you choose, ensuring you’re fully prepared to trade within safe boundaries.

Understanding the two types of drawdowns

At Fintokei, we’re dedicated to identifying real trading talent and guiding them towards a professional career. A key trait of a skilled trader is their ability to manage risk and minimize losses, making the drawdown the most critical metric we track. We monitor drawdowns in two distinct ways:

- daily drawdown, which is specific to our ProTrader program,

- and overall drawdown, which is relevant to all our trading programs.

Let’s start by examining the daily drawdown.

What is a daily drawdown and how is it calculated

A daily drawdown is the maximum loss allowed on your trading account within a single day. If this limit is exceeded, we consider it a hard breach of our rules, leading to the termination of your trading account/challenge. This metric is specifically calculated for participants in our ProTrader program.

How is the daily drawdown calculated?

Each day, precisely at midnight server time, our systems assess your account’s equity—the total value of your trading capital. From this, we establish the maximum tolerable daily drawdown limit, which is the threshold you should not breach the following day. For ProTrader participants, this daily drawdown limit is set at -5%. Understanding and adhering to this limit is crucial for managing risks and maintaining the integrity of your trading strategy.

Example:

Imagine you start trading with an initial capital of 100,000 EUR. After a successful first day, you manage to increase your equity to 103,000 EUR. At midnight (server time), our system automatically recalculates your daily drawdown limit based on your new equity. The new limit is set at 97,850 EUR, which is calculated as 103,000 EUR minus 5% (103,000 * 0.05).

Feeling confident, you dive into the next trading day sending multiple trades into the market. However, it turns out your confidence might have been a bit misplaced as the trades don’t pan out as expected. Luckily, you recognize the need to stop after a few unsuccessful attempts, and you finish the second trading day with a 2,000 EUR loss, leaving your total equity at 101,000 EUR. Despite the losses, you haven’t breached your daily drawdown limit of 97,850 EUR, so you can proceed with trading as usual the following day.

For the third day, your daily drawdown will be recalculated based on your new equity. Now, you must ensure that your account balance does not fall below 95,950 EUR, which is 101,000 EUR minus 5% (101,000 * 0.05).

As demonstrated, the daily drawdown limit is dynamic; it adjusts with changes in your account balance, providing you with more leeway to manage losses as your equity increases.

Don’t forget that you have to keep your drawdown in check even after completing the ProTrader challenge!

What is an overall drawdown and how is it calculated

Overall drawdown is an all-encompassing metric that applies to all Fintokei programs. It is calculated from your initial available capital in your account right from the start in the case of SwiftTrader, or after completing the evaluation in the case of ProTrader. For both ProTrader and SwiftTrader, the maximum overall drawdown is set at -10%. Although the principle of overall drawdown is the same, the ways in which it is calculated differ for the ProTrader program and the SwiftTrader program.

| Overall drawdown | Daily drawdown | |

|---|---|---|

| ProTrader | – 10 % | – 5 % |

| SwiftTrader | – 10 % | none |

Overall drawdown of the ProTrader program

It’s pretty simple here. If you decide to try our most popular ProTrader 100,000 EUR program with an allowed total drawdown of 10%, your trading account balance must not fall below 90,000 EUR. With few exceptions, this amount does not change and remains the same for the duration of your trading. The exception to this is the ability to scale your account balance and thus change your total drawdown. We’ll talk more about scaling in a different article.

Overall drawdown of the SwiftTrader program

If you prefer to skip the evaluation phase and start trading with virtual capital right away, the SwiftTrader program might be just what you’re looking for. However, it’s important to note that the overall drawdown is calculated a bit differently in this program.

In SwiftTrader, the baseline for all drawdown calculations is your equity at the start of the trading day, known as Start of Day (SOD) equity. If your trading goes well and your SOD value rises above the initial balance we set for your account, this increase raises your overall drawdown threshold as well.

From that point forward, your overall drawdown is calculated based on the highest value your assets reach, referred to as the High Water Mark (HWM). We update the HWM daily, at the end of the trading day.

If all these metrics, concepts, and calculations seem overwhelming, don’t worry—we promise that the high-water mark is the last concept we’ll introduce here. You’re doing great keeping up with this detailed (yet very useful) guide!

What is High-Water Mark

The High-Water Mark (HWM) represents the peak value reached in a SwiftTrader account and plays a crucial role in calculating the overall drawdown. This value is updated at the beginning of each trading day based on the highest asset value your account has achieved. It’s important to note that the HWM is designed to either increase or remain the same – it never decreases, as it reflects the highest level of profit attained.

However, there is an exception: if you choose to withdraw profits from your SwiftTrader account, this will effectively lower your total available capital, necessitating a recalibration of the HWM to reflect this new balance. We will clarify how this adjustment is made with an example at the end of our discussion, ensuring you fully understand how withdrawals impact your trading metrics and strategy.

Example 1 HWM recalculation:

You decide to try SwiftTrader and buy a 10,000 EUR account. On the first day, you are successful and you are 100 EUR in profit. The new High-Water Mark value is thus 10,100 EUR – this is the highest balance in your SwiftTrader trading account. From this value, we will also calculate the overall drawdown (which is 10% for SwiftTrader). The amount you must never surpass is therefore calculated as follows:

10,100 – (10,100 x 0.1) = 9,090 EUR

With the newly calculated overall drawdown, you open several trading positions the next day, but you fail and drop to EUR 9590. This is still exactly 500 EUR from the allowed drop limit, so you can try your luck again the next day.

On the third day, you excel and, thanks to a savvy market move, you net a substantial profit of 1410 EUR on a single trade, boosting your account to 10,500 EUR. Given this increase, it’s time to update the High-Water Mark and consequently the overall drawdown limit again:

10,500 – (10,500 x 0.1) = 9,450 EUR

In this example, you can see that the maximum allowed drawdown on your account (overall drawdown) increases along with your profits.

Example 2: HWM and Profit Withdrawal:

On the fourth day of trading, your positive momentum continues and you successfully increase your account balance to 11,200 EUR. This achievement hits the profit target for your first payout, which is set at a 10% increase, allowing you to proceed to the next exciting step—profit withdrawal.

You decide to withdraw the entire profit of 1200 EUR. According to the SwiftTrader program’s first scaling level, which features a 50/50 profit split, you are entitled to half of this amount. We process your withdrawal request within 1-2 days and transfer 600 EUR to your bank account.

Following the withdrawal, your High-Water Mark resets to your initial capital of 10,000 EUR. Consequently, the new threshold—the value your account balance must not fall below—is recalculated as 9000 EUR (10,000 EUR minus 10%). This recalibration ensures that while you benefit from your profits, your trading strategy must still maintain a prudent boundary to manage risks effectively.

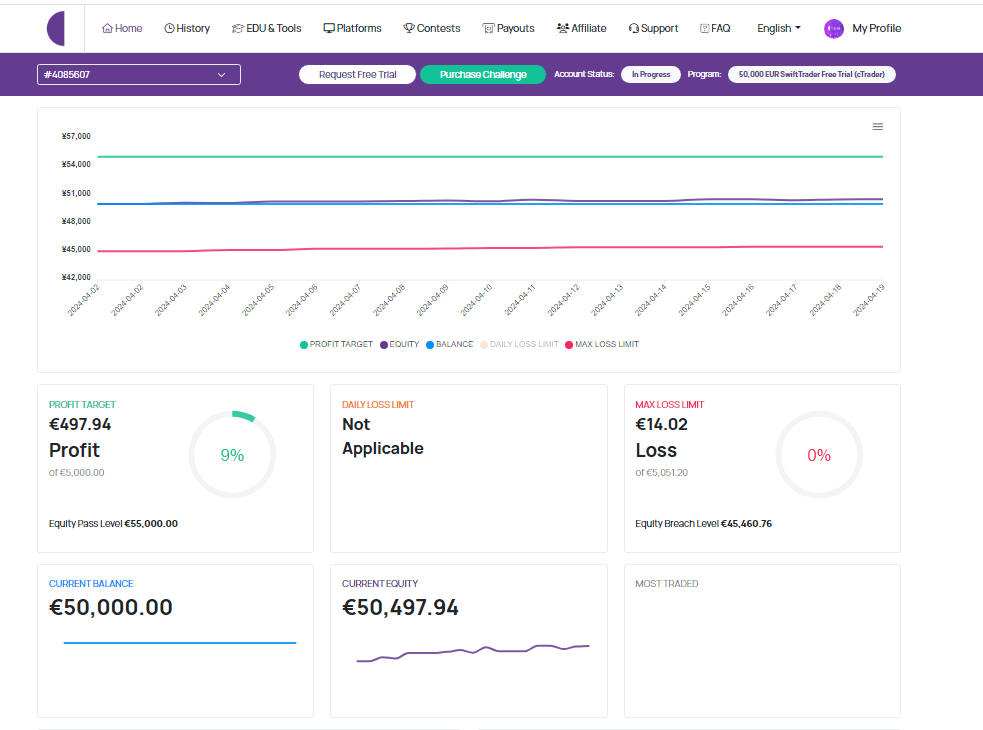

Good news! All drawdown and High-Water Mark calculations are tracked automatically in your MyFintokei zone!

While it’s wise to keep an eye on your daily drawdown, overall drawdown, and High-Water Mark, manually noting these figures on a piece of paper and sticking it to your monitor can be helpful, but you’ll find it much easier to monitor these metrics directly in your MyFintokei zone. This feature automatically keeps track of all these important values for you. Access to MyFintokei is granted as soon as you enroll in one of our programs, including the free trial versions. This tool not only simplifies your trading management but also helps ensure you stay within your trading parameters efficiently and effectively.

Conclusion

At Fintokei, we are dedicated to unlocking the true trading potential of our clients and demonstrating that with the correct information and disciplined trading habits, impressive results are within reach. However, successful trading extends far beyond haphazardly executing trades and hoping for the best.

The difference between aspiring professionals and reckless “shooters” lies in a meticulous and rational approach. Trading sensibly, adhering to a well-thought-out plan, and most importantly, practicing stellar risk management set the foundation for success. This is precisely why the drawdown metric, as explained in this article, is pivotal in all our programs. It’s not just about making trades; it’s about making smart decisions that safeguard your investments and maximize your trading potential.