How Do Japanese Traders Think?

Japanese traders make up a significant part of Fintokei’s community, and our data shows that their approach to trading is quite different from the European style. Let’s dive into what sets them apart!

A History of Online Trading in Japan

Japan has a long history with online trading. Japanese traders have been active since the late 1980s, and the move to computer platforms – and later mobile apps – was a game-changer for them. There’s even a specific group of Japanese female traders known as “Mrs. Watanabe.” These housewives have made waves in the forex market, and we’ve dedicated an article to their story. It’s worth a read!

What Makes Japanese Traders Unique?

Trade Frequency

Japanese traders are much more active than their European counterparts, often making multiple trades daily. Scalping and intraday trading are their favorite styles. Our record-holder, Yusuke, made 550 trades in just four months with a success rate of around 65%! Thanks to his solid money management skills, he collected 11 payouts worth a total of 3 million yen (about 500,000 CZK). Toward the end of this article, we’ll break down one of Yusuke’s standout trades – stay tuned!

Flexibility as the Key to Success

Another standout strength of Japanese traders is their adaptability. While they generally stick to strict risk management, they know when to adjust it to meet specific challenges. In our ProTrader program, for example, Japanese traders often tweak their risk-reward ratios to reach the 8% profit target. Their determination to meet their goals is impressive, but this approach isn’t for everyone. That’s why we also offer programs like StartTrader and SwiftTrader – ideal for traders who want to start with a simpler or quicker setup.

Risk Diversification with Multiple Accounts

Many Japanese traders manage multiple accounts simultaneously as a strategy for diversifying risk. One of our ProTrader clients, nicknamed Shalala (we promise we didn’t make that up!), explains his approach:

If I start losing on one account, I immediately stop trading on it and switch to the other, if I feel balanced. Sometimes, I take a break from trading altogether for the day. The next day, I’ll switch to the other account. It’s better than burning through one account and then another.

This method helps Japanese traders keep their emotions in check and avoid gambling-like behaviors. At Fintokei, we’re all about consistent traders, not gamblers. Managing multiple accounts strategically rather than taking on too much risk increases their chances of reaching payout milestones.

Trading on News Announcements? No, Thanks

While many European clients enjoy trading during macroeconomic news for the high volatility, Japanese traders take the opposite approach. They prefer to avoid the high-volatility moments that follow news announcements. Their style is typically based on classic Dow Theory, trading intraday but without the unpredictable spikes of news events. While Japanese traders can adjust their strategies as needed, they often stick to a single method they’ve mastered.

In terms of preferred instruments, Japanese traders favor USD/JPY and EUR/USD currency pairs, along with their home NIKKEI index. They remain loyal to their domestic markets and enjoy trading on familiar ground.

What Does Trading Japanese Style Look Like? Meet Trader Yusuke

To give you an example of a typical Japanese trader, let us introduce Yusuke, one of Fintokei’s active clients. Yusuke has been trading with us for just four months, yet he’s managed to earn a total of about 3 million yen (around $21,000). Yusuke is known for his high activity; he builds up his earnings gradually by trading smaller positions frequently. With an impressive 550 trades, most of which are intraday, he maintains a solid success rate of around 65%. Like many Japanese traders, Yusuke prefers trading the Nikkei stock index or currency pairs involving the Japanese yen.

Yusuke’s Most Profitable Trade

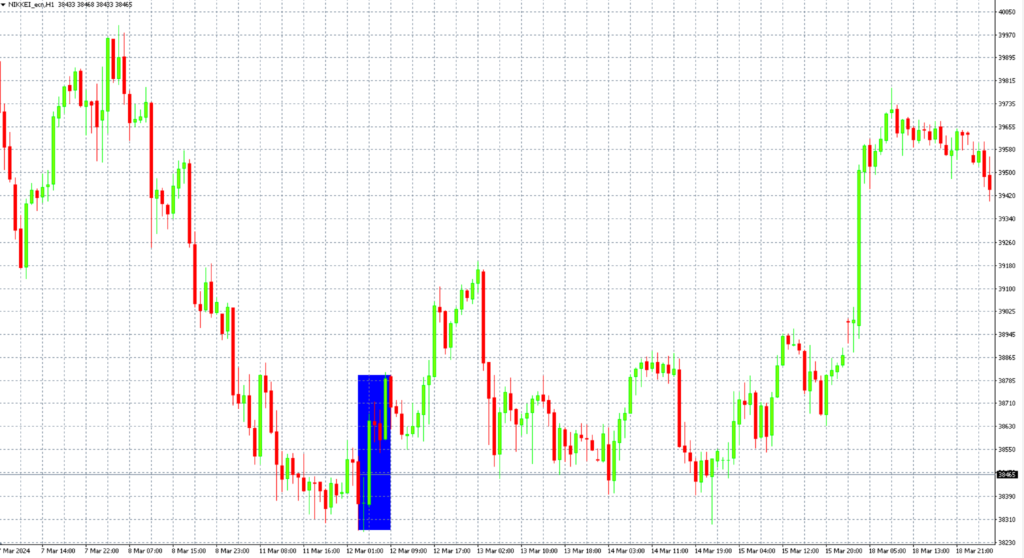

Yusuke’s greatest success came on the Nikkei index with a single intraday counter-trend trade that earned him over 1 million yen (about $7,000). Here’s the setup behind his standout trade.

A week before this trade (which occurred on March 12), the Nikkei index had reached an all-time high but then began to decline over several days. These price drops were largely due to investor concerns over an upcoming Bank of Japan meeting, where interest rate hikes were anticipated. Yet, there were subtle signs pointing to an early reversal and further gains – and Yusuke noticed them.

He timed his entry into a long position on the Nikkei index just two hours after the release of February’s producer inflation data, which met expectations. This steadied the markets, signaling a lower likelihood of a rate hike at the Bank of Japan meeting. As a result, the Japanese yen (JPY) began to weaken against the USD, further benefiting export-oriented companies and, by extension, the Nikkei index.

The final confirmation for Yusuke came from a doji candle with long wicks on the H1 chart, a common indicator of a possible trend reversal. With all these signals aligned, he entered his position and achieved his most profitable trade to date.

Like any skilled trader, Yusuke didn’t overlook the importance of risk management. Despite the strong signals, he set clear profit target (TP) and stop-loss (SL) levels. He chose the reference range of 38,300 to 38,800 points, where the Nikkei had consolidated the previous day.

With trend reversal signals in place and SL/TP levels set, Yusuke held steady, watching the market unfold. A huge 300-point candle confirmed his analysis, and thanks to his well-placed SL and TP levels, he successfully held through two red candles before the position closed at his take-profit level, right at the top of the previous day’s session.

Japanese traders like Yusuke combine careful preparation, adaptability, and strong discipline – a unique style that sets them apart. And how do you trade?