How Japanese Housewives Became Masters of the Forex Market

If you think trading is predominantly a male pursuit, this article might change your perspective. After all, talent knows no gender, as demonstrated by the trading prowess of Japanese "trading moms."

Intraday trading stands out as one of the most challenging disciplines in finance, demanding significant time and mental energy. Yet, the allure of financial independence beckons millions. Surveys, however, reveal a predominantly male presence in trading, with around 85% of traders being men. But in this article, we’ll shift our focus to a different group entirely.

Today, our journey takes us to Japan, where trading enjoys immense popularity, particularly among Japanese housewives. Intraday trading has captured their interest, and they’ve made a notable impact on the markets. What’s their secret? What strategies do they employ? And what lessons can ordinary traders learn from their success?

The rise in popularity of trading among Japanese women

The interest in trading among Japanese women started growing in the late 1980s. Back then, Japan’s economy was booming, and property prices were soaring, along with salaries. This meant many families could manage on just one income, often with the woman staying at home.

Japanese housewives began looking for ways to pass the time, and with Japan’s advanced technology, many turned to trading currency markets on their computers. Gradually, this hobby turned into a way for many women to earn money, which became even more important in the 1990s when Japan’s market bubble burst.

A lost decade in the land of the rising sun

A tough time hit Japan in the 1990s. Stock prices dropped sharply, wages stayed flat, and unemployment soared from 2% to over 5%. The Japanese currency also lost a lot of its value, and property prices fell steeply. It was a challenging period, often referred to as Japan’s lost decade. Interestingly, it took almost 35 years for Japan’s main stock index, the Nikkei 225, to recover its previous high.

To counter the crisis, the Bank of Japan gradually cut interest rates down to zero. But even that didn’t kickstart Japan’s economy. With interest rates at rock bottom, money in savings accounts didn’t earn any returns. In Japanese households, it’s usually the women who handle finances, so it’s not surprising that many turned to trading accounts offered by brokers instead of sticking with savings accounts.

Nikkei 225 index on the long-term chart. Source:Macrotrends

How Japanese housewives saved the economy

However, every crisis brings opportunities, and Japanese women traders seized them eagerly. These turbulent times favored skilled traders, particularly among Japanese housewives. Many of them found success, earning enough to support their families for years and even making millions of dollars.

The term “Mrs. Watanabe,” a common Japanese surname used to refer to this group of traders, became part of trader lingo. Under this name, a group of housewives, mostly in their 40s and 50s, with savings, made their mark on the market. These women traders not only influenced the Japanese market but also left a global impact. The Bank of Japan even indirectly thanked them, attributing the stabilization of the domestic currency to Japanese women who bought low and sold high. What was their secret? And what were their main strategies?

What was secret of their success?

The secret to their success lies in their conservative approach to trading, which contrasts with the aggressive tactics often associated with high-risk trading. Unlike their male counterparts, the “Watanabe ladies” prioritize risk management and steer clear of overly speculative trades.

Instead, they prefer longer-term investments and rely on technical analysis to identify trends and patterns in currency movements. Moreover, Japanese housewives are characterized by their patience and discipline in adhering to their trading plans. They recognize that consistent and persistent thinking is essential for success in trading, emphasizing the importance of setting stop losses, profit targets, and strictly following the RRR. These qualities align closely with what we value in traders at Fintokei.

What trading strategies do Japanese housewives use?

Carry Trading

Japanese traders often engage in carry trading, leveraging interest rate differentials between currencies to open positions where they earn the overnight interest rate of the currency they buy while paying interest on the currency they sell. This strategy gained popularity during the trading boom of the 1990s, given the substantial interest rate gap between the US and Japan. With interest rates in the US exceeding 6% while Japan’s rates hovered around 0%, speculating on buying USD and selling JPY was lucrative in terms of swaps.

The historical performance of the USD/JPY currency pair illustrates the potential profitability of speculating against the domestic currency. This strategy allows traders to capitalize on interest rate differentials while potentially profiting from currency appreciation. The USD/JPY currency pair continues to offer profit opportunities for traders in recent years, making it a viable strategy across generations.

USD/JPY v 90. Letech. Zdroj: Macrotrends

News trading

Trading forex pairs using carry trading may be considered more of a longer-term strategy, but Japanese traders are also comfortable with shorter trades. Additionally, trading macroeconomic news is highly popular, with such events occurring practically every day. To execute this strategy effectively, traders must possess a strong grasp of fundamental analysis and its interpretation. Japanese housewives adeptly respond to significant economic events or announcements by initiating trades based on their anticipated impact on currency markets.

- Positive news trading

When trading positive news, such as a favorable employment report from the United States, they anticipate a strengthening of the US dollar and accordingly enter long positions on USD currency pairs.

- Negative news trading

Negative news may prompt them to close short positions or adjust their trading strategies to minimize potential losses.

However, trading is inherently uncertain, and the same news can yield different effects. Therefore, maintaining a rigorous commitment to risk management is crucial, a practice at which Japanese traders excel.

Unlike many of our competitors, Fintokei allows our traders to engage in news trading without restrictions.

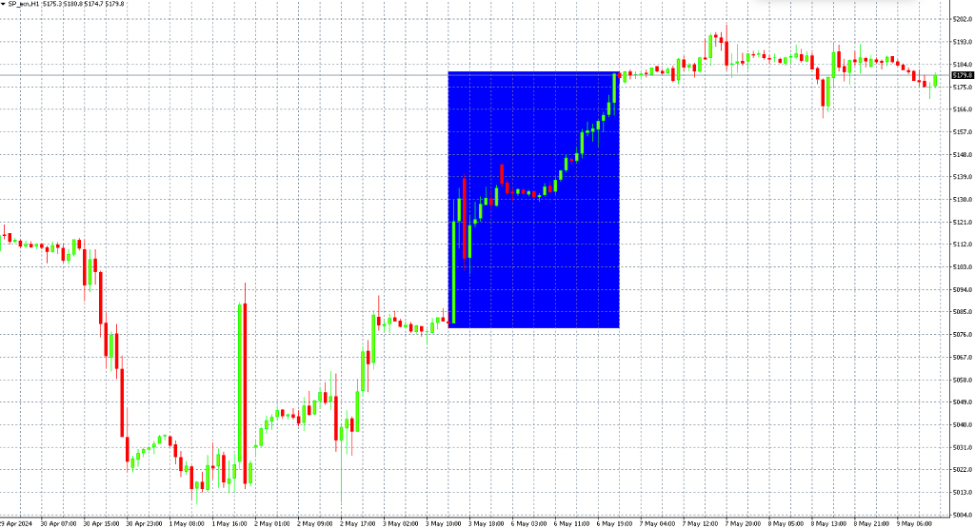

Example of news trading:

The S&P index strengthened significantly following news of rising unemployment in the US as well as lower-than-expected hourly earnings. In an environment of high inflation, this news was received positively as it could mean an earlier cut in interest rates.

Lessons for other traders

Conservative Trading is Viable

Forex trading doesn’t have to be solely about high-risk intraday or scalping trades. Strategies like Carry Trade, leveraging interest rate differentials, offer a more passive approach. By opening positions and benefiting from positive swaps, traders can adopt a less hands-on approach and still generate profits.

Adaptability is Key

Japanese traders exemplify the importance of adaptability. During periods of economic stagnation and crisis, they showcased the ability to find suitable strategies and remain profitable. This underscores the fact that there’s no universal trading strategy, and traders must be willing to adjust their approaches to changing market conditions.

Fundamental Analysis Matters

While trading solely based on technical analysis is possible, incorporating fundamental analysis can significantly enhance trading outcomes. By integrating economic calendars and considering the impact of fundamental factors on markets, traders can achieve more consistent and reliable results. Many successful traders, including those at Fintokei, attribute their success partly to fundamental analysis.

Emphasize Risk Management and Discipline

Perhaps the most crucial takeaway is the importance of risk management and discipline. Implementing strategies such as setting stop-loss and take-profit levels, adhering to established rules, and maintaining a trading journal are fundamental to responsible trading practices. Successful traders, including the legendary Ms. Watanabe, have built their success on these principles.