Pin bar formation and how to trade it

The pin bar candlestick formation is one of the most well-known patterns in technical analysis. It helps traders recognize moments when the market loses momentum and a trend reversal is likely. In this article, we’ll show you how to make the pin bar an essential part of your trading strategy.

There are many paths to trading success. Some require constant monitoring of global events and studying the economic calendar, while others involve installing complex indicators and programs. But sometimes, all you need is to spot the right candlestick on the chart.

What is a pin bar formation?

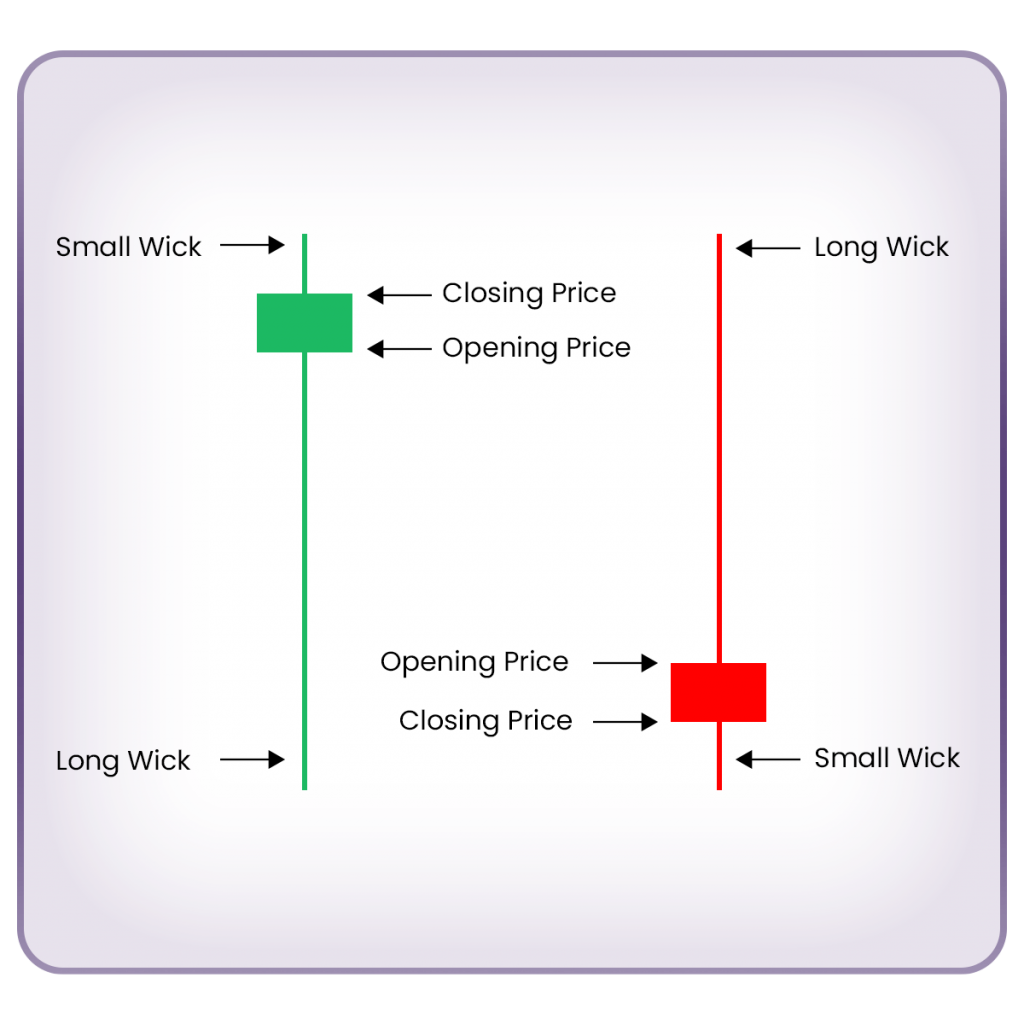

A pin bar (also known as a pinbar) is a single-candle formation with a small body and a long wick (shadow). Its shape resembles a pin, which is where the name comes from. The pin bar belongs to the reversal formations, as it signals a potential change in the market trend.

You can imagine the pin bar formation as a battle between bulls and bears, where one side had the upper hand, but at the last moment, the market reversed, and the other side gained control. This strong shift in market sentiment is represented by the long wick of the candle.

Types of pin bar formations

A bearish pin bar has a long wick at the top, with a small body at the bottom. A bearish pin bar signals a potential market reversal downward. The market tested higher prices, but they were strongly rejected, leading to a decline.

A bullish pin bar has a long wick at the bottom, with a small body at the top. A bullish pin bar signals a possible market reversal upward. The market tested lower prices, which ultimately resulted in a strong upward reversal.

How to trade the pin bar formation?

Successful use of the pin bar pattern in trading depends on several factors. Below is a proven step-by-step approach to trading this formation effectively.

1. Identify the pin bar

The pin bar candle often appears at key support and resistance levels, trendlines, or Fibonacci retracements. The more pronounced the long wick and the smaller the body, the stronger the signal the formation provides.

2. Confirm your entry with additional indicators

Never rely solely on the pin bar. To confirm your entry, use indicators such as RSI (Relative Strength Index) to determine overbought or oversold market conditions and MACD (Moving Average Convergence Divergence) to reveal market momentum and potential trend reversals.

3. Wait for the right moment to enter the market

For a bullish pin bar, enter a long position after the candle closes. For a bearish pin bar, enter a short position when the market confirms a downward movement.

4. Risk management is key

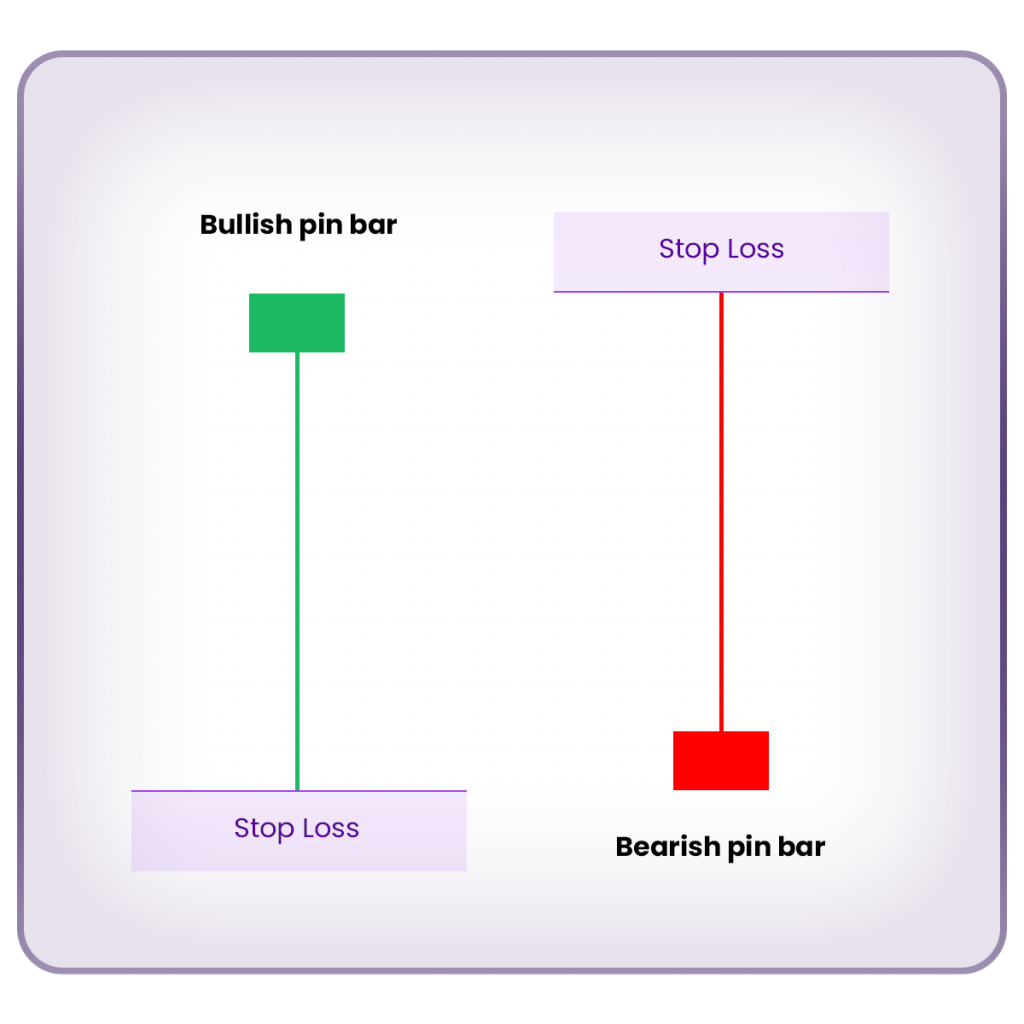

For a bearish pin bar, place a stop loss above the highest price of the candle. For a bullish pin bar, place a stop loss below the lowest price of the candle. Never forget the stop loss—markets are unpredictable, and false signals can occur. A minimum risk-reward ratio of 1:2 is recommended to maximize potential profits while minimizing losses.

Summary: Pin bar as a key signal for traders

The pin bar formation is a powerful price action pattern and a fundamental element of technical analysis. Whether you trade a bullish pin bar at support or a bearish pin bar at resistance, always combine the pin bar candle with additional indicators, such as economic fundamentals, to increase your probability of success.