The Untold Winners of the US Election

The trading event of the year is over, and Fintokei clients made the most of it, like trader Daniel, who successfully navigated the market and was thrilled with the outcome of Donald Trump's election.

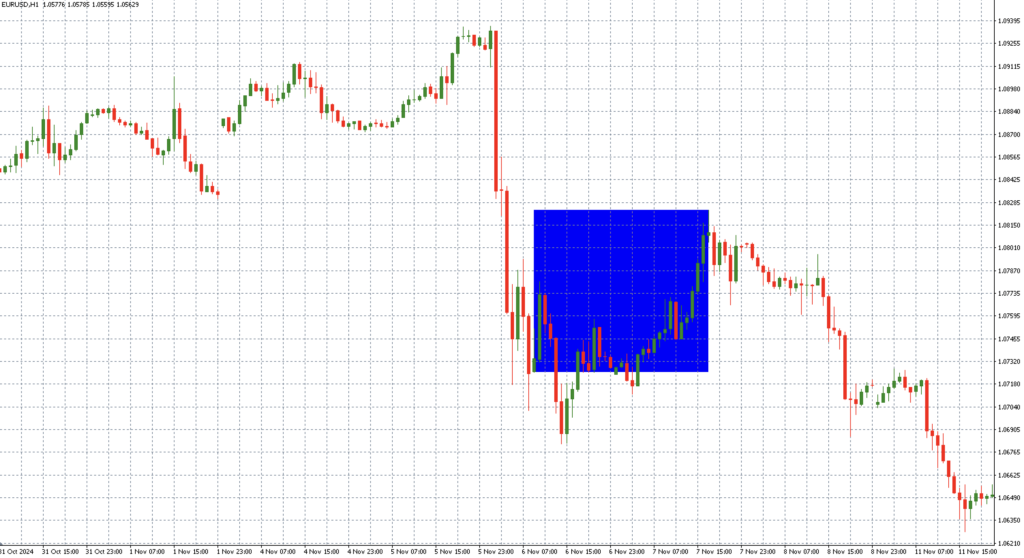

The US presidential election was the most anticipated event of the year, especially for traders, as it brought the one thing they value most: market volatility. In the days leading up to the election, prices in stocks, commodities, and Forex markets became wildly unpredictable, creating big opportunities for those who could navigate the chaos. One of them was our trader Daniel, who turned this volatility into a profit with his swing trading masterpiece. Let’s dive into his strategy.

When Trump’s Election Works in Your Favor

Traded Instrument: EUR/USD

Trading Style: Swing

Profit: $ 11,620

For traders, the US presidential election wasn’t just the event of the year—it was a golden opportunity. The massive market activity brought profit potential in every direction, whether in stock indices, commodities, or forex. The chaos after the results was felt everywhere, but trader Dan was ready for it. His target? The EUR/USD pair, and he rode its drop to a $ 11,620 profit.

Dan’s choice of EUR/USD wasn’t random—it was a calculated move. Here’s why Donald Trump’s election made the dollar so strong:

- Tariffs and Inflation

Trump’s plans to impose tariffs on foreign goods meant higher prices, leading to inflation. To combat inflation, the central bank was expected to keep interest rates high, making the dollar more attractive to investors. - Trump: The Geopolitical Wild Card

Trump’s unpredictable approach to international relations left global leaders and diplomats uneasy. When global uncertainty spikes, investors flock to the dollar as a safe haven, boosting its value.

A few days before the election, the dollar weakened slightly as Kamala Harris gained momentum in polls. Trump’s clear victory then shocked markets, triggering a sharp drop in EUR/USD. Dan stayed calm, waiting for the price to stabilize and climb back up. The day after the election, he entered a buy position as the market turned. With a 10 million CZK ProTrader account, he set his volume to 7.5 lots, seizing the rebound with precision.

Before entering, Dan noticed the price tested and returned to the previous low, which hinted at possible manipulation. This created an interesting entry point, likely with a larger stop loss. His position delivered quick profits, but Dan chose to hold on. In hindsight, he may have regretted it—moments later, EUR/USD reversed, putting him at a loss.

A new low formed, accompanied by a bullish fair value gap, a key indicator in technical analysis often watched by our traders. If the market accepted this, a continuation downward was likely. But it didn’t. Instead, the gap became new support, and the price rebounded. Confident in his analysis, Dan took advantage of the lower price to add another buy position of 2 lots.

The market then moved as Dan predicted. Traders began taking profits from the post-election rally, leading to a gradual dollar weakening. As the price returned near his original entry, Dan added another 2.5 lots. By 5 PM the next day, the upward rally peaked, and Dan closed his entire 12.5-lot position, securing a total profit of $ 11,620.