Top trades of June at Fintokei

Even the slower market pace of the summer months didn’t stop our traders from achieving impressive results. Join us as we take a look at the best trades of the past month!

The excellence of Fintokei traders shone through despite the market’s slower pace. In June, they found opportunities mainly in gold and forex and didn’t hesitate to short the market. Their gains significantly boosted the total volume of performance rewards paid out, which exceeded €1,500,000 so far this year.

And all this happened amidst the exciting news we’re planning at Fintokei. You can look forward to two new trading programs and one huge surprise. However, we’ll keep the big reveal under wraps for now.

For now, let’s dive into the best trades of Fintokei traders for the month of June!

20k euro in Gold in 10 Hours

| Instrument Traded | Gold |

| Trading Style | Intraday |

| Profit per Trade | 3,535,110 JPY (approximately 20,000 EUR) |

Gold is the number one instrument among our traders due to its high volatility. Everyone is competing to make the most impressive trade on this precious metal. The current leader in this friendly competition is a Japanese trader named Aoi T. How did he achieve such remarkable results?

Market Context

Aoi cleverly chose a period of volatility for his trade, capitalizing on market reactions to several key fundamentals and political instability in France. Let’s break down the events leading up to his successful trade.

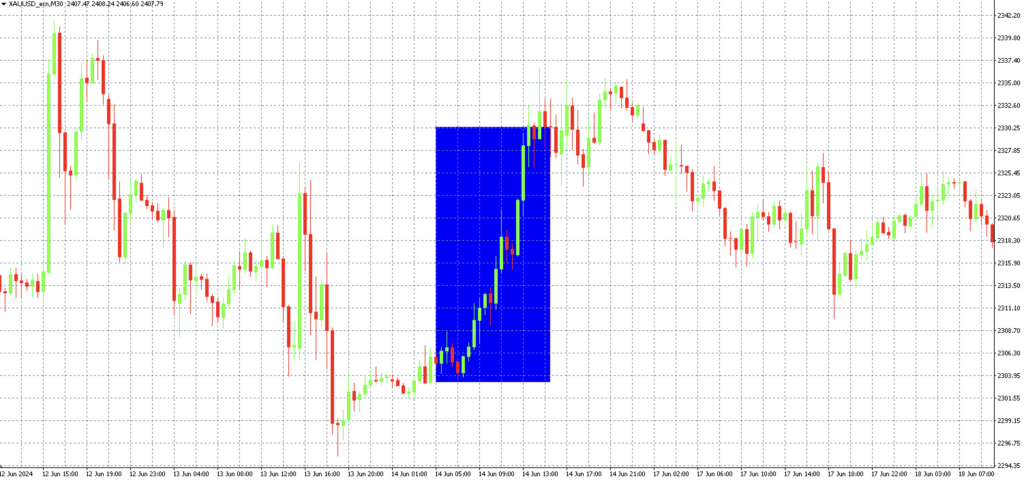

Two days before the actual trade, which occurred at 5 am on June 14, key CPI inflation data was announced in the US. The data showed lower-than-expected numbers, reducing the likelihood of a rate cut. In market terms, this meant a weaker dollar and a rise in gold prices.

However, these expectations were overturned by the Fed meeting at 8 pm on the same day. During the meeting, a significantly worse economic projection was announced, with higher expected inflation and interest rates. Consequently, gold prices fell sharply over the next two days.

During this period, our trader Aoi was patiently preparing for his opportunity…

The following day, the US PPI inflation data was released and came in below expectations. Gold started to rise as traders took quick profits, but the looming threat of the Fed meeting projections sent gold below the important psychological level of $2300.

If you look at the chart above, you may notice a few doji candles during the overnight session. These often indicate an early reversal in the trend. The exaggerated sell-off in gold from the previous day further suggested this reversal. Aoi knew it was time to act!

Market Entry

Aoi chose to enter the position at 5 am, just after the Bank of Japan meeting, where rates were maintained at the current level. With no important fundamentals expected to be announced that day, the probability of gold recovering from the exaggerated losses of the previous day was high.

A stop loss was set at the previous session’s low of around $2295, or slightly below the psychological level of $2300. The take profit was set at the top of the previous day’s intraday session, just below $2330. The reversal of sentiment was further supported by the situation in France, where forecasts suggested a strong chance for the extreme right to win, favoring gold.

Following the pre-set risk-reward ratio, Aoi exited the position 10 hours later, just below the $2330 level, earning JPY 3,535,110 (approximately 20,000 EUR).

Did You Know? Other instruments can also help improve the readability of gold trends.

Read about them in our article and start trading gold like a pro.

Read articleShort Trade on Forex with impressive results

| Instrument Traded | USD/JPY |

| Trading Style | Intraday/Scalp |

| Profit per Trade | 2,110,000 JPY (approximately 12,213 EUR) |

On the same day (June 14), another fascinating trade took place in Japan, but this time it was on the USD/JPY currency pair. Unlike the previous gold trade, this one was much shorter, lasting only about 27 minutes. Despite its brevity, a Japanese trader named Ryo I. managed to earn over 2,110,000 Japanese yen, approximately 12,213 EUR.

Market Context

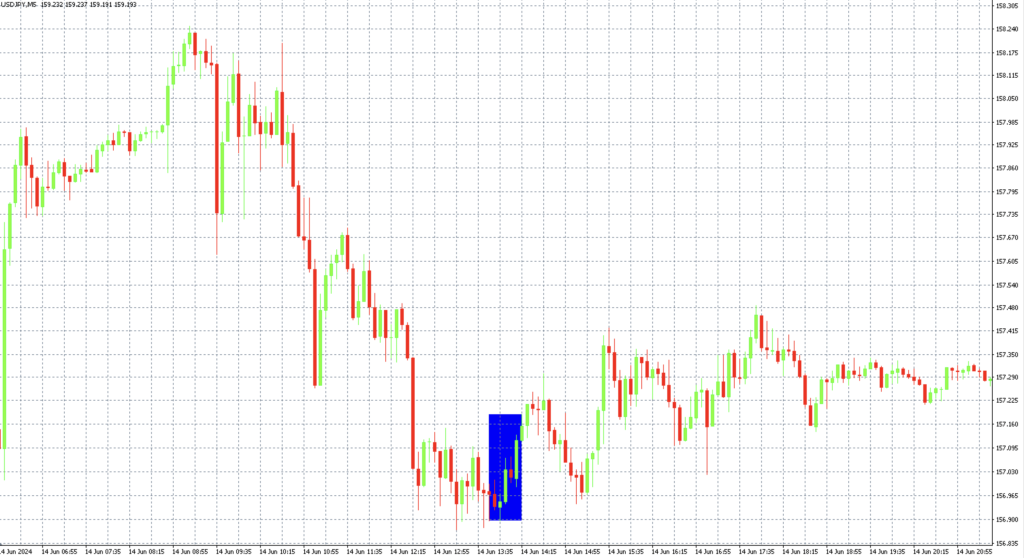

On June 14, there was significant volatility in the USD/JPY pair due to the Bank of Japan meeting. Shortly after 5 am, the Bank announced that it would keep interest rates unchanged. This move disappointed part of the market, as it had made the same decision at the previous meeting. In contrast, at the March meeting, the Bank had raised interest rates in response to high inflation in Japan. As a result, the USD/JPY pair rose sharply from around 157 to 158.2 just after 5 am.

However, the increase was not without its challenges. At 8:30 am, a press conference by the central bank governor, Ueda, began. He did not rule out the possibility of raising interest rates at the next meeting if the weakness in the JPY persists. This statement reinforced the central bank’s stance on monetary policy, leading to an appreciation of the JPY and causing the USD/JPY currency pair to fall back to around 157.

Market Entry

Our trader, Ryo, was closely monitoring the situation, anticipating that the strengthening of the Japanese yen (and the resulting drop in USD/JPY) would be temporary. This pattern had occurred several times throughout the year, and the long-term trend for the USD/JPY pair was clearly upward. Ryo patiently waited for the right moment to enter the market.

The opportunity came around 1:45 pm when Ryo entered a long position. About an hour before that, the USD/JPY pair began to consolidate with a sideways move. At 1:45 pm, two dragonfly doji candles formed on the 5-minute chart, signaling a potential early trend reversal. This reversal indeed occurred, and Ryo used the 21-pip move to take a profitable position. He exited less than 30 minutes later, which proved to be a wise decision, as the US foreign trade data release was imminent, causing the JPY to appreciate again.

A Bet Against Fiber That Paid Off

| Instrument Traded | Fiber (EUR/USD) |

| Trading Style | Intraday/Scalp |

| Profit per Trade | 10,091 EUR |

One of the main advantages of trading with CFD instruments is the ability to speculate on both price increases and decreases. This is exactly what one of our Italian clients, Mattia M., successfully did.

Market Context and Market Entry

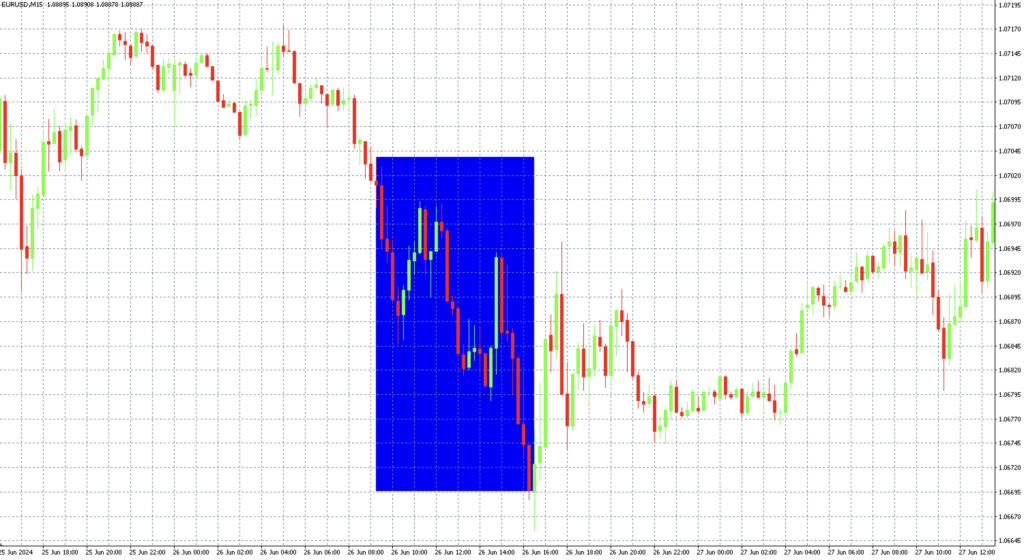

Before Mattia entered the market shortly after 9 a.m. on June 26, the first signal appeared. This came from consumer confidence data in Germany and France, both of which came in below expectations, negatively impacting the euro.

The second signal, confirming the entry into a short position, was a candle formation similar to the “three black crows,” which appeared when the important psychological level of 1.0700 was broken. With a stop loss set just above this level, Mattia could set a take profit at the first support level of 1.069 or at the stronger support level of 1.067.

There was a short-term trend reversal at the first support level, but Mattia’s position did not go into negative territory. He was able to weather the short-term trend reversal and generate higher profits by exiting the position at 1.0672. The absence of fundamental news on that day also played in his favor. At 12:30 pm, ECB Chief Economist Lane gave a speech, but his comments were unrelated to the current monetary policy situation.

As a result, Mattia took home a profit of 10,091 EUR for the day.

Can You Identify a Market Trend?

The trend is your friend. Learn to recognize it by reading our educational article.

Read articleCzech Forex Trading Lessons

| Instrument Traded | EUR/JPY |

| Trading Style | Intraday/Scalp |

| Profit per Trade | Approximately 105,000 CZK |

Market Context and Market Entry

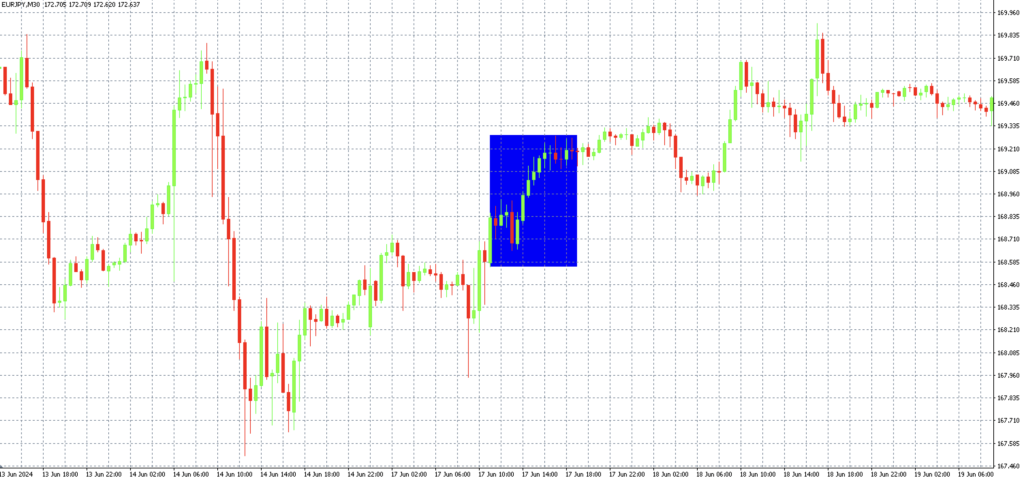

At 11 am, ECB Governor Christine Lagarde gave a speech expressing concern about the impact of the political situation in France on the eurozone economy. This comment alone would likely have weakened the EUR against the JPY.

However, just after 11 am, closely watched Eurozone wage data for the first quarter was released, showing a year-on-year growth of 5.3%, well above expectations. Such high wage growth complicates the central bank’s efforts to bring inflation down to its 2% target. Consequently, the market’s outlook for interest rate cuts this year was reconsidered.

The euro began to strengthen following the published data, which Tomas K. capitalized on. He entered a long position at 168.768 and, after more than 7 hours, ended it with a profit of almost 38 pips. He exited the position after a prolonged uptrend when consolidation began to form in the market and two consecutive doji candles signaled a potential early market reversal. Although the reversal did not occur, Tomas had already closed the trade, securing his profit.