Zoom in: Trading fundamentals – Central bank meetings and how to trade them

If you want to trade news events, you first need to understand them. No worries - that’s exactly what our Focus on Fundamentals series is for. In this third episode, we dive into how to trade central bank meetings!

Fintokei is one of the few prop firms that allows unrestricted trading during news releases. So why not take advantage of it? In the last episode, we covered how to trade labor market data. This time, we’ll show you how central bank decisions move financial and stock markets. 🔥

So get your economic calendar ready – let’s go!

Why central bank meetings matter

Central bank meetings are among the most important fundamental events moving the financial markets. Monetary policy decisions influence forex, bond yields, stocks, and commodities.

Put simply – interest rates shape economies.

If you want to trade fundamentals successfully, it helps to:

- Understand how central banks operate.

- Know what drives their decision-making.

- Be prepared ahead of each meeting

Even if you’re a pure technical trader, knowing central bank meeting dates can save you from unexpected volatility. These events have serious market-moving power.

Key markets affected by central banks:

Forex

Rising interest rates usually boost the local currency – higher rates attract capital. In short: interest is the price of money.

Stocks

Lower rates often support stock markets, as cheap borrowing fuels expansion. When companies thrive, so do their shares.

Bonds

Bond yields are closely tied to interest rate expectations. Bond traders are often the first to react – and other markets follow.

Commodities

Looser monetary policy (i.e. lower rates) typically lifts gold and other commodities, as it hints at stronger future demand and economic expansion.

How to track central bank meetings

Central banks publish their meeting calendars months in advance. Your best friend here? The economic calendar – you’ll find key events listed well ahead of time.

Or just visit the central banks’ own websites for the latest updates.

Here are some sources you should follow:

🧾 Press conferences

Most meetings are followed by a press conference. Here, central bankers explain their decisions and give forward guidance. Sometimes, the conference matters more than the decision itself—it’s where journalists dig deeper, and big clues can drop. Waiting for the conference before trading can be a smart move.

📈 Macroeconomic projections

The Fed and ECB release forecasts for inflation, GDP, and unemployment every quarter. If their outlook differs significantly from market expectations, volatility is almost guaranteed.

📝 Meeting minutes

Detailed records of central bank discussions – usually released weeks after the meeting. In the U.S., these are known as “minutes” and often reveal how united (or divided) the decision really was.

💬 Individual comments

Statements from central bank members – even outside of official meetings – can shift expectations. Speeches from governors carry the most weight. But not all speeches are about inflation or monetary policy, so be patient and selective with your attention.

How to trade around central bank meetings

1. Before the meeting: Analyze expectations

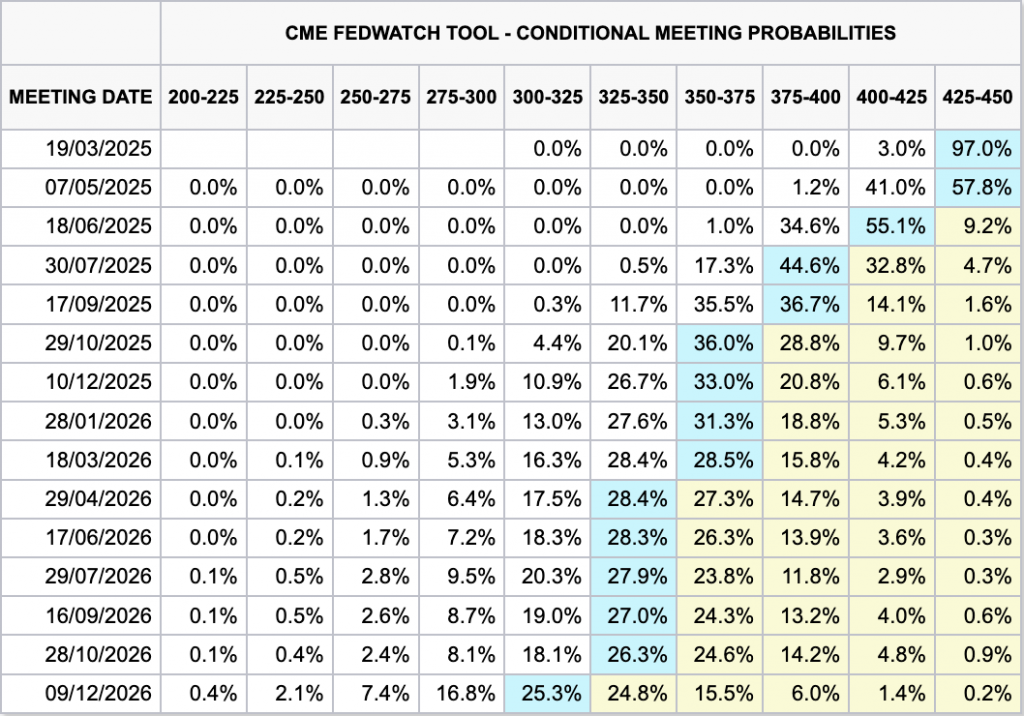

- Track the market’s rate expectations (e.g., CME’s FedWatch Tool for the Fed).

- Analyze recent macro data: inflation, jobs, GDP growth.

- Monitor public statements from central bankers.

- Beware of extreme consensus – if most expect a hike but the bank sounds dovish, expect a market shake-up.

2. On meeting day: React to the decision

- The market reacts instantly to the announcement.

- Surprises trigger high volatility.

- Initial moves can be exaggerated or even reversed – stay alert and track the trend.

- Watch the tone of the press conference and accompanying materials.

3. After the meeting: Monitor the aftermath

- Sometimes, the market takes hours or days to react fully.

- If the decision matches expectations, the reaction might be muted.

- If traders focus more on future meetings, price action could remain choppy.

Top central banks to watch

Not all central banks have the same impact. These five are the big players:

- Federal Reserve (Fed) – The world’s most important central bank. Its decisions shape the entire global financial system.

- European Central Bank (ECB) – Crucial for the eurozone, with wide-reaching influence across Europe.

- Bank of Japan (BoJ) – Famous for its unique monetary policy and surprise interventions. Big impact on Forex.

- Bank of England (BoE) – Closely watched for its impact on the volatile British pound.

- Swiss National Bank (SNB) – Known for shocking the market, especially in connection with the Swiss franc.

Real-world example: SNB surprise rate cut

📆 On December 12, 2024, the Swiss National Bank (SNB) surprised the market by slashing interest rates by 50 basis points – from 1.0% to 0.5%. Analysts expected only a 25-point cut.

The reaction was instant:

- The Swiss franc dropped sharply against the U.S. dollar.

- Traders dumped the franc, as lower rates made it less attractive.

- USD/CHF shot up within minutes, posting the biggest move in over a year.

🧠 Why the SNB acted:

To prevent excessive franc appreciation, which could hurt Swiss exporters and economic growth. Low inflation gave the SNB room to ease. Officials made it clear they were ready to act again if needed.

Lesson?

Wait for the unexpected. That’s where real trading opportunities lie.